vehicle personal property tax richmond va

Apply the 350 tax rate. Personal Property Registration Form An ANNUAL filing is required on all.

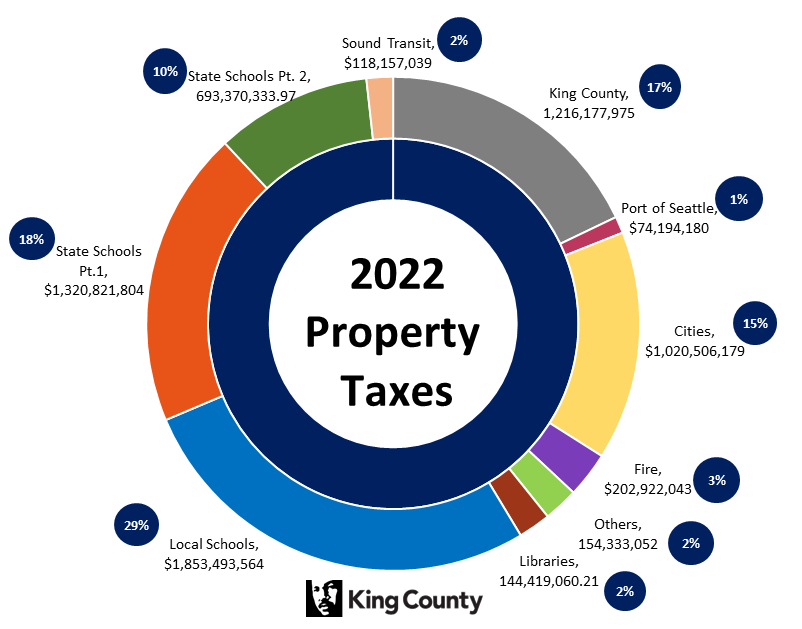

Property Taxes How Much Are They In Different States Across The Us

Calculate personal property relief.

. Personal Property taxes are billed annually with a due date of December 5 th. 350100 x 10000 35000. Click Here to Pay Parking Ticket Online.

WWBT - If you live in Chesterfield County you may have noticed a spike in personal property taxes especially when it comes to your car. Failure to report a vehicle within 60 days will result in a 10 late filing penalty that will be added to the personal property tax bill. Answer the following questions to determine if your vehicle qualifies for personal property tax relief.

Personal Property Tax Car Richmond Va. Leases Leased personal property such as cars and trucks is taxable at the personal property tax rate. Reduce the tax by the relief amount.

Parking tickets can now be paid online. For questions regarding mobile homes please contact the Commissioner of the Revenue by phone at 804-748-1281 or via email at Commissioner of the Revenue. A higher-valued property pays more tax than a lower-valued property.

So I moved to Richmond in August and after I registered my car to VA I got a letter about the personal property tax and they wanted me to mail them. 804 520-9266 Hours 830 AM - 500 PM View Staff Directory. Pay Your Parking Violation.

Owners of vehicles displaying out-of-state plates who are not otherwise exempt from obtaining Virginia license plates will be charged an additional annual. Is more than 50 of the vehicles annual mileage used as a business. Restaurants In Erie County Lawsuit.

Mobile Homes Mobile Homes are assessed using the of cost at the rate of 130 per 10000. Interest is assessed as of January 1 st at a rate of 10 per year. Is more than 50 of the vehicles annual mileage used as a business expense for federal income tax purposes OR reimbursed by an employer.

Personal Property Tax also known as a car tax is a tax on tangible property - ie property that can be touched and moved such as a car or piece of equipment. 226 for 2021 x 35000 7910. To visit the site register your alarm or make a payment visit Cry Wolf.

Majestic Life Church Service Times. This is required whether the vehicle is titled in Virginia or in another state or country. Vehicle personal property tax richmond va Friday February 18 2022 Edit.

Opry Mills Breakfast Restaurants. Personal Property Taxes are billed once a year with a December 5 th due date. Failure to receive a tax bill does not relieve you of the penalty and the interest on a past due bill.

Personal Property Tax. The 10 late payment penalty is applied December 6 th. 12000 Government Center Parkway Suite 223.

Personal property taxes on automobiles trucks motorcycles low speed vehicles and motor homes are prorated monthly. Woman Breaks World Speed Record By Riding A Bicycle At 147 Mph Bicycle Women Bicycle Bike 541 Ruckers Rd New Homes Real Estate Listings Real Estate. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year.

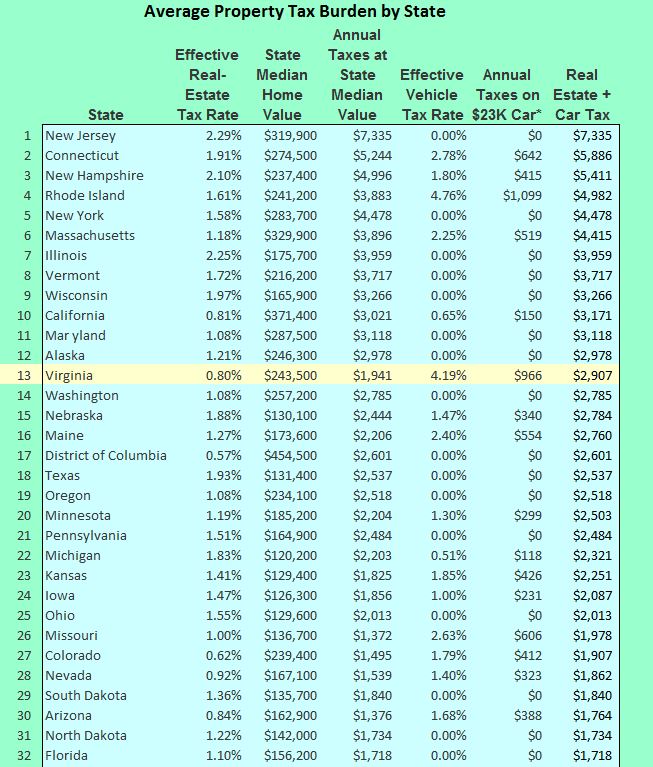

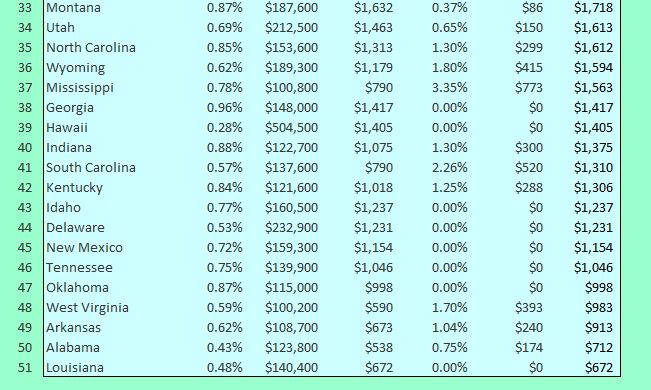

Are Dental Implants Tax Deductible In Ireland. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. To contact customer service regarding questions about your false alarm bill call toll-free 1-877-893-5267.

If you have questions about your personal property bill or would like to discuss the value. The county also can consider high mileage and damage beyond regular wear and tear in assigning values to vehicles. Real property tax on median home.

Call 804 646-7000 or send an email to the Department of Finance. We are open for walk-in traffic weekdays 8AM to 430PM. Assessed value of the vehicle is 10000.

Vehicle personal property tax richmond va Thursday March 3 2022 Edit. Team Papergov 1 year ago. Example Calculation for a Personal Use Vehicle Valued at 20000 or Less.

Many residents called 12 On Your Side and. If a vehicle is subject to the taxes in Alexandria for a full calendar year the tax amount is determined by multiplying the tax rate by the assessed value. Use our website send an email or call us weekdays from 8AM to 430PM.

Southside Richmond Virginia Wikiwand Experts Pull Documents Money From Lee Statue Time Capsule Wavy Com 4003. Real Estate and Personal Property Taxes Online Payment. Parking Violations Online Payment.

If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief. Home personal richmond va vehicle. Home property richmond va vehicle.

Restaurants In Matthews Nc That Deliver. City Code - Sec. City of Colonial Heights 201 James Avenue PO.

As used in this chapter. 703-222-8234 TTY 711. Commissioner of the revenue means the same as that set forth in 581-3100For purposes of this chapter in a county or city which does not have an elected commissioner of the revenue commissioner of the revenue means the officer who is primarily responsible for assessing motor vehicles for the.

Boats trailers and airplanes are not prorated. It is an ad valorem tax meaning the tax amount is set according to the value of the property. Personal Property Taxes.

In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons. Box 3401 Colonial Heights VA 23834 Phone.

Sales Tax State Local Sales Tax on Food. Other Useful Sources of Information Regarding False Alarm Fees. Recreational Vehicles Recreational vehicles are assessed using the NADA book of Recreational Vehicle Appraisal Guide at a rate of 150 per 10000.

2 days agoRICHMOND Va. Personal Property Tax Relief 581-3523. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief.

Virginia Property Taxes Not As Bad As Jersey But Worse Than D C Bacon S Rebellion

Aba Tax Services Xero Accountant Property Business And S M S F Specialists Business Insurance Small Business Insurance Car Insurance

Virginia Property Tax Calculator Smartasset

Tax Bill Information Macomb Mi

Eliminating Virginia S Vehicle Property Tax Isn T Part Of Glenn Youngkin S Tax Relief Plan Wset

News Flash Chesterfield County Va Civicengage

28 Key Pros Cons Of Property Taxes E C

Pin By Susan Phillips On Bad In 2022 Richmond Tampa Knoxville

Property Tax Relief Available For Richmond Seniors Wric Abc 8news

Pay Online Chesterfield County Va

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Virginia Property Taxes Not As Bad As Jersey But Worse Than D C Bacon S Rebellion

Loudoun S Data Center Tax Revenue Is Accelerating At An Insane Pace Washington Business Journal

Real Estate Tax Frequently Asked Questions Tax Administration

Get The Title Of Property Reviewed Before Selling Title Insurance Title Buying A New Home